The Congress of South African Trade Unions (Cosatu) has entered the fray over the proposed Value-Added Tax (VAT) increase, suggesting that the government negotiate a pension contribution holiday with the Government Employees Pension Fund (GEPF) to address the country’s R60 billion budget deficit.

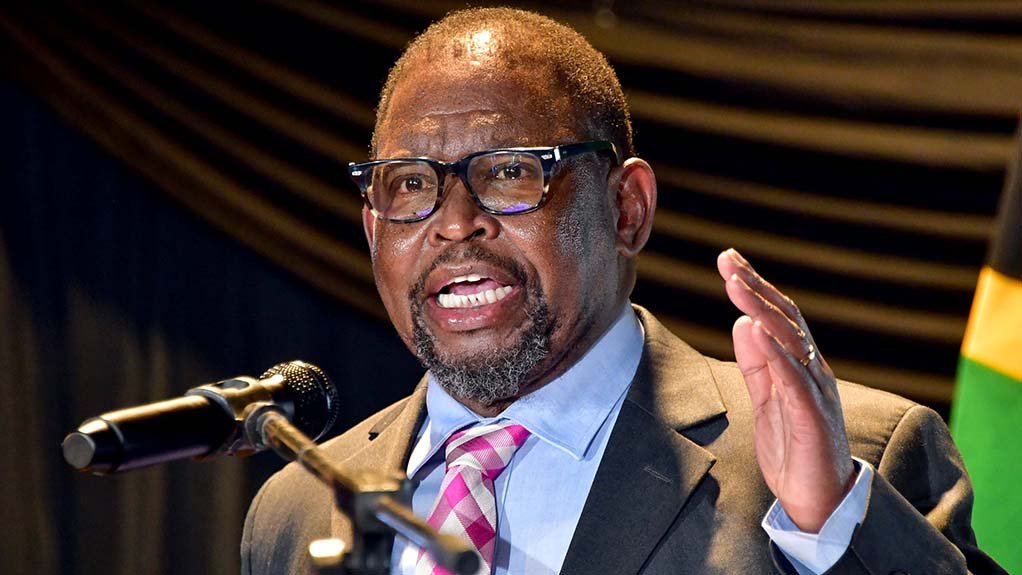

Finance Minister Enoch Godongwana is set to present a revised budget to Cabinet on March 12, following delays caused by disagreements within the Government of National Unity (GNU). Initially, a 2% VAT hike was on the table, but reports indicate that President Cyril Ramaphosa may propose a more moderate increase of between 0.5% and 1%. However, the Democratic Alliance (DA), led by John Steenhuisen, remains opposed, insisting that VAT should stay at 15%.

Cosatu’s Pension Fund Proposal

Cosatu’s parliamentary coordinator, Matthew Parks, urged Treasury to consider a pension contribution holiday for government employees, which could free up approximately R53 billion. This would be achieved by temporarily suspending the employer’s portion of contributions for one year.

“Some ideas may be practical, others not, but we want to give government different options to consider,” Parks explained. “A pension fund holiday is one such option.”

Parks emphasized that the GEPF is overfunded at 110% capacity, making a temporary holiday feasible. Since it is a defined benefit scheme, worker payouts remain unaffected regardless of market fluctuations.

“The GEPF manages over R2 trillion for 1.2 million members. A pension holiday would carry no risk for workers, but the details need to be clearly explained to them,” he added.

Cosatu also warned the government that if it proceeds with the pension holiday option, it must ensure public sector vacancies are filled and wage agreements are honored.

Opposition to the VAT Increase

Cosatu has been vocal in its opposition to a VAT hike, arguing that it disproportionately burdens the poor.

- Advertisement -“Workers are already struggling to survive amid rising costs of electricity, petrol, and basic goods,” Parks said. “We support taxation, but it must be fair. The wealthy should contribute more.”

The DA has also rejected the VAT hike and proposed alternative budget cuts to save R60 billion without raising taxes. Their suggested measures include:

- A 50% reduction in government advertising budgets

- A 33% reduction in travel and catering expenses for government officials

- A hiring freeze on non-essential public sector positions

“We are not opposed to taxation, but we reject unfair taxation that targets the poor,” Steenhuisen stated. “There are better ways to manage the budget shortfall without making life harder for struggling South Africans.”

A Divided Government

The VAT proposal has exposed deep divisions within the GNU. While some argue that an increase is necessary to fund public services, critics warn that it will place an undue financial strain on low-income households.

Political analyst Sandile Swana believes Cosatu’s call for wealthier individuals to be taxed more is “a step in the right direction.”

“South Africa’s tax system is regressive, meaning the poor carry a heavier burden. It’s time for a more progressive approach,” Swana said.

Another analyst, Dr. Thabo Mokoka, agreed that Cosatu and the DA have valid concerns.

“The ANC needs to carefully reconsider its position. The backlash against a VAT hike is growing,” Mokoka noted.

Economic expert Siyabonga Sibiya added that even a modest 0.75% VAT increase would be difficult for South Africans to absorb.

“At this point, it’s up to the GNU to decide. But the real question people are asking is: Where is all this money going?” Sibiya concluded.

Looking Ahead

With the March 12 budget deadline fast approaching, all eyes are on the GNU’s next move. Will the government heed Cosatu’s call for a pension holiday? Or will it push ahead with a VAT increase despite fierce opposition?

One thing is certain—the coming weeks will be critical in determining South Africa’s economic path.