Nedbank’s ambitious R1.65-billion acquisition of South African fintech company iKhokha has cleared a crucial regulatory hurdle after the Competition Commission recommended that the Competition Tribunal approve the transaction without conditions.

According to the Commission, the deal “is unlikely to substantially lessen or prevent competition in any market” and “does not raise significant public interest concerns.” That recommendation effectively paves the way for one of the largest local fintech acquisitions in recent years.

Nedbank’s Big Fintech Move

Announced in August 2025, the acquisition will see Nedbank purchase 100% of iKhokha in an all-cash transaction valued at R1.65 billion, subject to minor adjustments at closing. Once concluded, iKhokha will become a wholly owned subsidiary of Nedbank but will continue operating under its own brand and leadership team.

The agreement includes a comprehensive management lock-in to maintain operational continuity and strategic alignment with Nedbank’s long-term growth goals. For iKhokha’s early investors — Apis Partners, Crossfin Holdings, and the International Finance Corporation (IFC) — the deal represents a successful and lucrative exit after more than a decade of partnership.

“These investors played a crucial role in scaling iKhokha’s operations and driving product innovation,” both companies said in a joint statement.

A Startup Built from Scratch

Founded in 2012 by Matt Putman and Ramsey Daly, iKhokha began as a bold idea inspired by small business challenges. Putman, then a university student and part-time nightclub owner, found himself frustrated by clunky card payment systems offered by South Africa’s major banks.

That frustration planted the seed for iKhokha — a mobile-driven payment solution for small businesses that would later evolve into a comprehensive fintech ecosystem. With his father, Dr. Clive Putman, an electronics engineer, Matt built an early prototype inspired by a Fortune magazine article on Jack Dorsey’s Square (now Block).

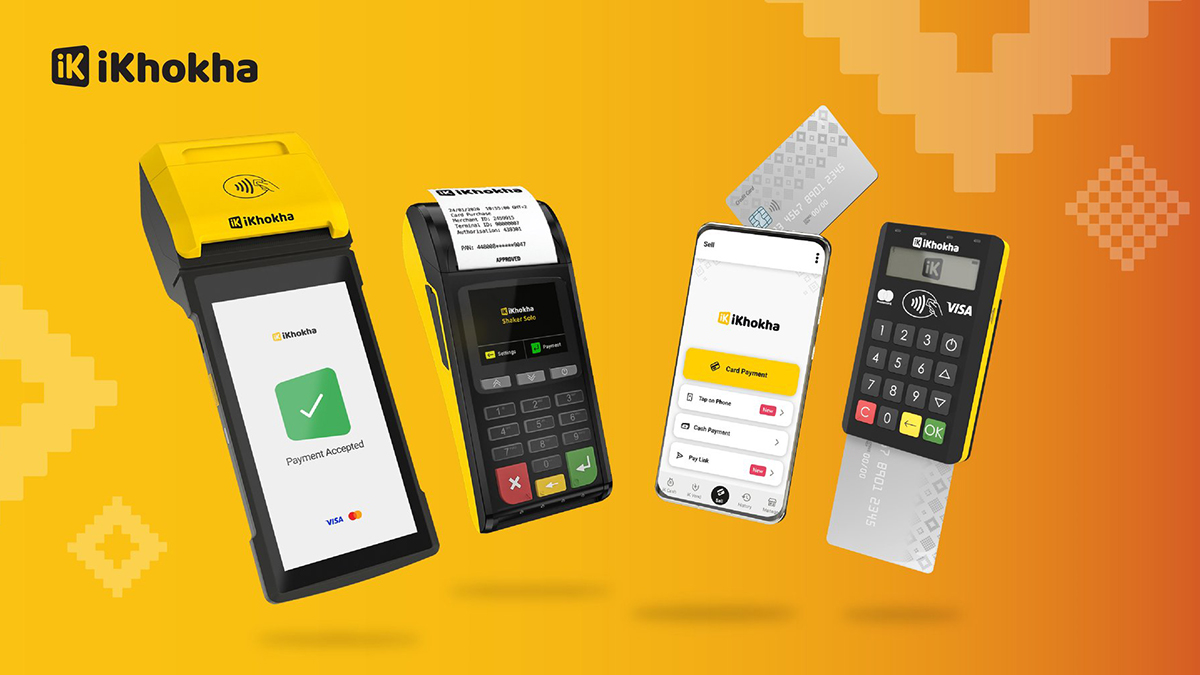

Over time, iKhokha grew into one of South Africa’s leading fintech players, offering payment terminals, cash advances, and business management tools to thousands of small and medium-sized enterprises (SMEs).

“This is a proud moment for both the founders and the broader iKhokha leadership team,” said Putman, the company’s CEO and co-founder. “Joining forces with Nedbank gives us the platform to scale our impact, accelerate innovation, and unlock new value for our merchants.”

He added that the partnership aligns deeply with their shared vision of empowering entrepreneurs and hinted at potential expansion into other African markets.

Nedbank’s SME Push

Nedbank’s leadership has framed the acquisition as a strategic leap in its long-term plan to empower South Africa’s SME sector — a cornerstone of the nation’s economy.

“This acquisition is a natural evolution of our existing relationship with iKhokha,” said Ciko Thomas, Nedbank’s Group Managing Executive for Personal and Private Banking. “By combining their innovative technology with our deep banking experience, we can deliver world-class tools for small businesses to thrive.”

Nedbank Group CEO Jason Quinn echoed that sentiment, calling the acquisition a pivotal step in the bank’s digital transformation strategy. “Together, we will unlock new opportunities for growth and financial inclusion in South Africa and potentially abroad,” Quinn said.

What This Means for South Africa’s Fintech Landscape

The Nedbank–iKhokha merger signals growing confidence in South Africa’s fintech industry, which has become a key driver of financial inclusion and innovation. With major banks increasingly partnering or acquiring tech startups, the line between traditional banking and digital finance continues to blur.

For entrepreneurs, the collaboration promises better tools, improved access to credit, and integrated digital services — while for investors, it reflects a maturing fintech sector capable of billion-rand deals and global relevance.

As the Competition Tribunal considers the final approval, few expect major obstacles. For Nedbank and iKhokha, this deal could mark the beginning of a new era for South African small businesses — one where access to digital payments and financial tools becomes as commonplace as a till at the counter.