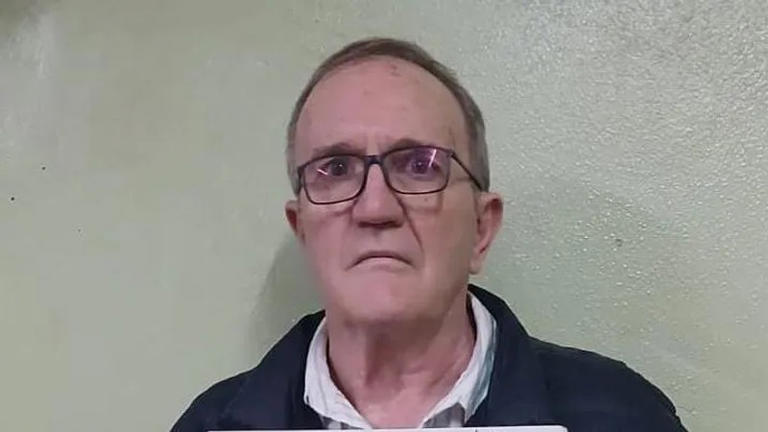

A man accused of pulling off one of the more eye-watering financial scams in recent years has made his first court appearance after surrendering himself to authorities. Jacobus Stefanus Geldenhuis, a 65-year-old who allegedly masqueraded as a financial advisor, handed himself over to the Hawks’ Serious Commercial Crime Investigation unit before appearing in the Palm Ridge Specialised Commercial Crimes Court.

Authorities say Geldenhuis faces 21 counts of fraud and money laundering connected to a scheme that allegedly swindled victims out of a staggering R100 million. According to investigators, he managed to convince unsuspecting individuals to deposit their hard-earned money into multiple accounts under the guise of lucrative offshore investments.

The Hawks revealed that none of the funds were ever invested. Instead, the investigation uncovered that Geldenhuis had been disbarred as a financial advisor back in 2009. To add another layer of trouble, his company was never registered with the Financial Sector Conduct Authority, leaving victims legally and financially exposed.

Warrant Officer Thatohatsi Mavimbela, spokesperson for the Hawks in Gauteng, confirmed that victims suffered losses totalling R100 million due to the alleged scheme. She noted that Geldenhuis presented himself as a legitimate advisor, using that image to win the confidence of his clients.

Mavimbela explained that Geldenhuis surrendered voluntarily on Thursday morning, which led directly to his first appearance before the court. Despite the scale of the allegations, he was granted bail of R10,000—a figure that may raise a few eyebrows but remains within the court’s discretion.

The matter has been postponed to 26 January 2026 to allow the defence team to receive and review the full docket. For now, the long legal road ahead is set, and victims will be watching closely to see whether justice tracks the money trail with the same determination they once trusted in their alleged advisor.

This case adds yet another reminder of how vital it is to verify financial credentials—especially when large sums and “too-good-to-be-true” offshore promises are involved.