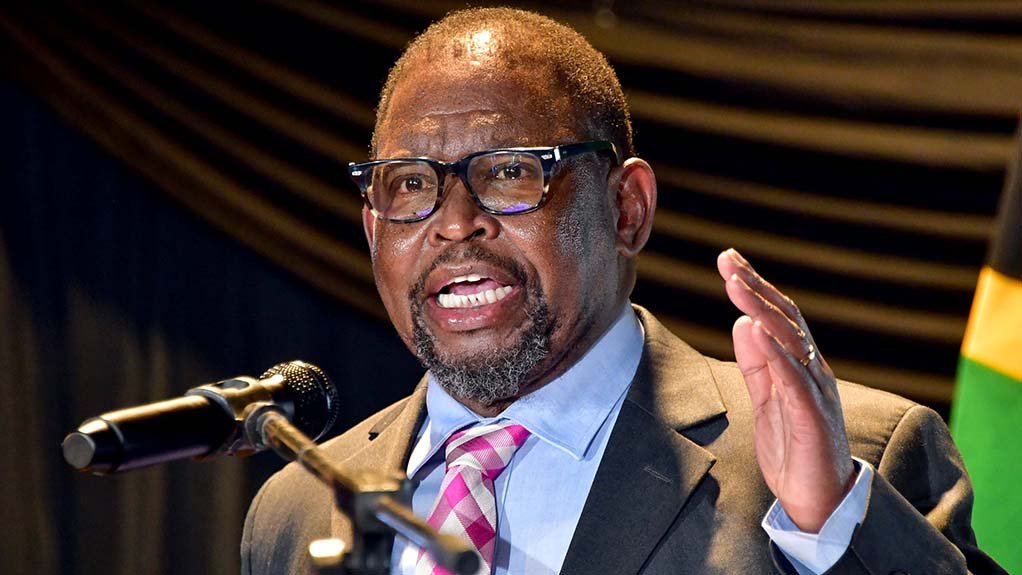

Finance Minister Enoch Godongwana says South Africa will not create a broad cryptocurrency exchange control exemption. Instead, the South African Reserve Bank (SARB) will publish a detailed framework later this year to govern cross-border transfers of crypto assets.

The announcement comes in response to a landmark Pretoria High Court ruling in May, which found that existing exchange control rules do not apply to cryptocurrencies and called for urgent reform. Judge Mandlenkosi Motha ruled that crypto is not money under current law, describing it as “an asset that is bought and sold” and citing its global, code-based nature.

Court Criticism of SARB’s Delay in Regulating Crypto

Motha criticised regulators for failing to implement a clear framework despite crypto’s 15-year existence, saying:

“Cryptocurrency has been in existence for over 15 years; one cannot say SARB has been caught napping.”

The ruling effectively exempts crypto from exchange controls until new regulations are in place — a decision SARB has since appealed.

What the New Framework Will Cover

Godongwana, responding to parliamentary questions from DA MP Wendy Alexander, confirmed that the upcoming SARB framework will:

- Define rules for crypto asset service providers (CASPs), including exchanges such as Luno, VALR, and Binance

- Set parameters for externalising and repatriating value through crypto

- Introduce administrative and reporting requirements to curb illicit financial flows

- Close loopholes that could allow regulatory arbitrage

The framework will be developed in consultation with the National Treasury, the Financial Sector Conduct Authority (FSCA), and other financial regulators.

Current Regulatory Landscape

Crypto service providers are already regulated under several laws:

- Since December 2022, CASPs have been listed as accountable institutions under the Financial Intelligence Centre Act (FICA), requiring anti-money laundering compliance.

- In October 2022, the FSCA classified crypto assets as financial products under the FAIS Act, subjecting them to licensing and advisory regulations.

However, exchange control rules remain a grey area, particularly after FinSurv’s 2021 clampdown that restricted South African banks from processing payments to overseas crypto platforms and criminalised certain transfers abroad.

Next Steps

Godongwana said the new SARB framework will aim to balance consumer protection, anti-money laundering safeguards, and innovation, while preventing illicit outflows.

If the Supreme Court of Appeal upholds Judge Motha’s ruling, it would represent a major shift in South Africa’s treatment of crypto — and a setback for FinSurv’s historic stance.